A Guide to Getting Wiser with Your Money in 2024 and Beyond: Defying the Tax Man

Are you looking to get wiser with your money in 2024 and beyond? This guide will provide you with the essential information you need to make smart financial decisions, minimize your taxes, and achieve your financial goals.

4 out of 5

| Language | : | English |

| File size | : | 1966 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 36 pages |

| Lending | : | Enabled |

Chapter 1: The Basics of Money Management

In this chapter, we will cover the basics of money management, including budgeting, saving, and investing. We will also discuss the importance of having a financial plan and setting financial goals.

Budgeting

A budget is a plan for how you will spend your money each month. It is important to create a budget so that you can track your income and expenses, and make sure that you are not spending more money than you earn.

There are many different ways to create a budget. You can use a spreadsheet, a budgeting app, or even just a piece of paper. The most important thing is to find a system that works for you and that you will stick to.

Saving

Saving money is important for a number of reasons. It can help you to reach your financial goals, such as buying a house or retiring early. It can also provide you with a financial cushion in case of an emergency.

There are many different ways to save money. You can set up a savings account, contribute to a retirement plan, or simply put aside a certain amount of money each month.

Investing

Investing is a great way to grow your money over time. However, it is important to remember that investing involves risk. Before you invest, it is important to do your research and understand the risks involved.

There are many different ways to invest. You can invest in stocks, bonds, mutual funds, or real estate. The best investment strategy for you will depend on your individual financial goals and risk tolerance.

Chapter 2: Tax Planning

Taxes are a major expense for most people. However, there are a number of things you can do to minimize your tax liability.

Deductions

Deductions are expenses that you can subtract from your income before you calculate your taxes. There are many different types of deductions, including:

- Standard deduction

- Itemized deductions

- Business expenses

- Retirement contributions

Credits

Credits are amounts that you can subtract directly from your tax bill. There are many different types of credits, including:

- Child tax credit

- Earned income tax credit

- Retirement savings credit

Tax loopholes

Tax loopholes are legal ways to reduce your tax liability. However, it is important to note that tax loopholes can be complex and difficult to understand.

If you are not sure how to take advantage of tax deductions, credits, or loopholes, you should consult with a tax professional.

Chapter 3: Retirement Planning

Retirement planning is an important part of financial planning. The sooner you start planning for retirement, the more time you will have to save and invest.

There are many different retirement planning options available, including:

- 401(k) plans

- IRAs

- Annuities

The best retirement planning option for you will depend on your individual financial situation and goals.

Chapter 4: Other Financial Planning Topics

In addition to the topics covered in this guide, there are a number of other important financial planning topics that you should be aware of, including:

- Estate planning

- Insurance

- Education planning

- Emergency planning

By understanding these topics, you can make informed financial decisions that will help you achieve your financial goals.

Getting wiser with your money is an important part of achieving financial success. By following the advice in this guide, you can make smart financial decisions, minimize your taxes, and achieve your financial goals.

4 out of 5

| Language | : | English |

| File size | : | 1966 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 36 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Samuel Levin

Samuel Levin Saeed Naqvi

Saeed Naqvi Rihito Takarai

Rihito Takarai Martin Ruhs

Martin Ruhs Mari Yamazaki

Mari Yamazaki Rachel Kowert

Rachel Kowert Sifu Slim

Sifu Slim Mark Weakland

Mark Weakland William Mark Habeeb

William Mark Habeeb Matt Fox

Matt Fox Mary Taylor Simeti

Mary Taylor Simeti Rosemary Mahoney

Rosemary Mahoney Matthew Harper

Matthew Harper Martina Mcbride

Martina Mcbride Martin Olson

Martin Olson Mary Jo Ignoffo

Mary Jo Ignoffo Marks Prep

Marks Prep Tod Polson

Tod Polson Mark Jones

Mark Jones Meg Emerson

Meg Emerson

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Jeff FosterBreak the Mold: The Revolutionary Tale of the First Student-Run High School...

Jeff FosterBreak the Mold: The Revolutionary Tale of the First Student-Run High School... Harold BlairFollow ·11.3k

Harold BlairFollow ·11.3k Reginald CoxFollow ·7.2k

Reginald CoxFollow ·7.2k Spencer PowellFollow ·6k

Spencer PowellFollow ·6k Gabriel Garcia MarquezFollow ·7.3k

Gabriel Garcia MarquezFollow ·7.3k Natsume SōsekiFollow ·7.5k

Natsume SōsekiFollow ·7.5k Isaias BlairFollow ·9.9k

Isaias BlairFollow ·9.9k Foster HayesFollow ·11.5k

Foster HayesFollow ·11.5k Darnell MitchellFollow ·16.9k

Darnell MitchellFollow ·16.9k

Larry Reed

Larry ReedGwendy's Final Task: A Thrilling Conclusion to a Timeless...

Prepare to be...

Victor Turner

Victor TurnerHow FDR Defied Polio to Win the Presidency

Franklin D. Roosevelt is...

Edwin Cox

Edwin CoxWinner RGS BBC Journey of a Lifetime Award: An Inspiring...

In the heart of the world's...

Griffin Mitchell

Griffin MitchellEverything You Need to Know, You Learned From Mister...

Mister Rogers' Neighborhood was a beloved...

Beau Carter

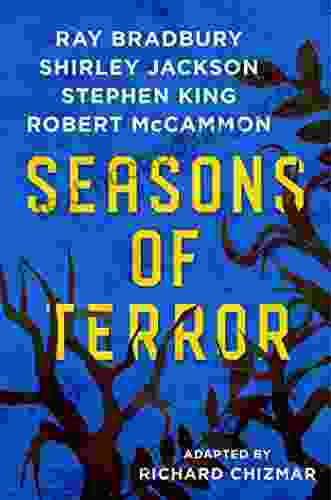

Beau CarterSeasons of Terror: A Spine-Tingling Odyssey into the...

In the realm of horror...

4 out of 5

| Language | : | English |

| File size | : | 1966 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 36 pages |

| Lending | : | Enabled |