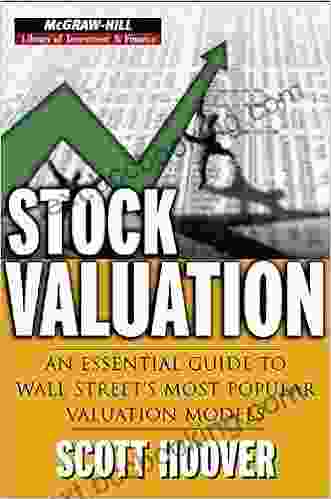

An Essential Guide to Wall Street's Most Popular Valuation Models

Empowering Investors and Analysts with the Tools of the Trade

In today's dynamic financial landscape, making sound investment decisions requires a deep understanding of valuation methodologies. Wall Street's most popular valuation models provide a comprehensive toolkit for investors, analysts, and anyone seeking to navigate the complexities of financial markets. This essential guide serves as your ultimate companion, demystifying the intricacies of these models and equipping you with the knowledge to make informed investment choices.

4.7 out of 5

| Language | : | English |

| File size | : | 4386 KB |

| Text-to-Speech | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 400 pages |

| Screen Reader | : | Supported |

Deciphering the Building Blocks of Valuation

Before delving into specific valuation models, it is crucial to understand the fundamental concepts that underpin them. We explore the principles of discounted cash flow analysis, market multiples, and relative valuation, providing a solid foundation for model selection and interpretation.

The Discounted Cash Flow Framework

Discounted cash flow (DCF) models project a company's future cash flows, discounted back to the present value to determine its intrinsic worth. We delve into the different DCF variations, including the free cash flow to equity (FCFE) and the weighted average cost of capital (WACC),explaining how these techniques are employed to estimate a company's long-term value.

Harnessing Market Multiples

Market multiples leverage comparable companies and industry benchmarks to ascertain a company's value. We examine the most widely used multiples, such as price-to-earnings (P/E) ratios and enterprise value (EV) to sales ratios, discussing their strengths and limitations in different market scenarios.

The Power of Relative Valuation

Relative valuation compares a company to its peers or industry indices, identifying relative overvaluation or undervaluation. We cover various relative metrics, including price-to-book (P/B) ratios and debt-to-equity (D/E) ratios, and demonstrate how these tools can uncover hidden investment opportunities.

Advanced Valuation Techniques

For more complex valuation scenarios, we explore advanced techniques such as option pricing models (OPM),real options analysis, and Monte Carlo simulation. These models provide sophisticated valuation frameworks for companies with unique characteristics, such as high growth potential or significant financial leverage.

Case Studies and Real-World Applications

To bridge the gap between theory and practice, we present real-world case studies and illustrate how valuation models are applied in various industry sectors. These case studies provide invaluable insights into the decision-making process of investment professionals and demonstrate the practical application of valuation principles.

Ethical Considerations in Valuation

While valuation models are powerful tools, it is essential to recognize the ethical implications associated with their use. We discuss the potential for bias, conflicts of interest, and the need for transparency in the valuation process, emphasizing the importance of integrity and ethical conduct for both analysts and investors.

An Essential Guide to Wall Street's Most Popular Valuation Models is an indispensable resource for anyone seeking to master the art of financial valuation. By providing a comprehensive toolkit and practical insights, this guide will empower investors, analysts, and financial professionals to make informed decisions, navigate complex market dynamics, and unlock the potential for financial success.

4.7 out of 5

| Language | : | English |

| File size | : | 4386 KB |

| Text-to-Speech | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 400 pages |

| Screen Reader | : | Supported |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Vivian Gibson

Vivian Gibson Martin Goldstein

Martin Goldstein Matt Cooper

Matt Cooper St Louis Post Dispatch

St Louis Post Dispatch Titus M Kennedy

Titus M Kennedy Marjan Kamali

Marjan Kamali Mel Lindauer

Mel Lindauer Michael Frank

Michael Frank Maria Venegas

Maria Venegas Steve Mcmenamin

Steve Mcmenamin Mark Mccrum

Mark Mccrum Tapirus

Tapirus Steven Rybin

Steven Rybin Pam England

Pam England Simon Heffer

Simon Heffer Michelle Down

Michelle Down Michael Eric Dyson

Michael Eric Dyson Peggy Vincent

Peggy Vincent Martise Moore

Martise Moore Orestes Lorenzo

Orestes Lorenzo

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Jermaine PowellFollow ·19.6k

Jermaine PowellFollow ·19.6k Orson Scott CardFollow ·16.2k

Orson Scott CardFollow ·16.2k Hector BlairFollow ·15.2k

Hector BlairFollow ·15.2k Robert HeinleinFollow ·16k

Robert HeinleinFollow ·16k Edwin CoxFollow ·9.5k

Edwin CoxFollow ·9.5k Angelo WardFollow ·9.6k

Angelo WardFollow ·9.6k Jack LondonFollow ·17.5k

Jack LondonFollow ·17.5k John Dos PassosFollow ·12.9k

John Dos PassosFollow ·12.9k

Larry Reed

Larry ReedGwendy's Final Task: A Thrilling Conclusion to a Timeless...

Prepare to be...

Victor Turner

Victor TurnerHow FDR Defied Polio to Win the Presidency

Franklin D. Roosevelt is...

Edwin Cox

Edwin CoxWinner RGS BBC Journey of a Lifetime Award: An Inspiring...

In the heart of the world's...

Griffin Mitchell

Griffin MitchellEverything You Need to Know, You Learned From Mister...

Mister Rogers' Neighborhood was a beloved...

Beau Carter

Beau CarterSeasons of Terror: A Spine-Tingling Odyssey into the...

In the realm of horror...

4.7 out of 5

| Language | : | English |

| File size | : | 4386 KB |

| Text-to-Speech | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 400 pages |

| Screen Reader | : | Supported |