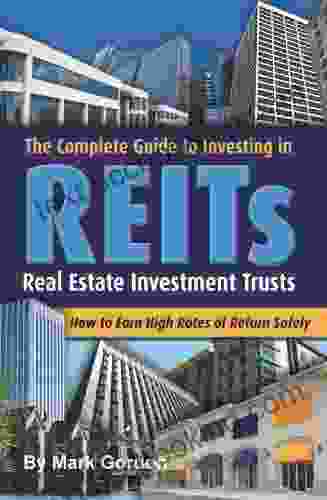

How to Earn High Rates of Returns Safely

In the pursuit of financial freedom, the allure of high rates of return can be tantalizing. However, navigating the investment landscape safely requires a well-informed and strategic approach. This comprehensive guide will unravel the secrets of earning high rates of returns while preserving your financial well-being.

4.2 out of 5

| Language | : | English |

| File size | : | 2889 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Word Wise | : | Enabled |

| Print length | : | 288 pages |

Understanding the Risk-Return Relationship

Investing involves a delicate balance between risk and reward. Higher returns generally come with higher risks, while lower risks yield lower returns. Understanding this relationship is crucial for setting realistic expectations and tailoring your investments to your risk tolerance.

Assessing Your Risk Tolerance

Before embarking on any investment strategy, it's essential to assess your risk tolerance. Consider your age, financial situation, investment goals, and emotional resilience to market fluctuations. Determining your risk appetite will guide you in selecting investments that align with your comfort level.

Diversification: The Cornerstone of Safe Investing

Diversification is a fundamental principle of safe investing. By spreading your investments across different asset classes and sectors, you reduce the risk of losing substantial capital in the event of a single asset or market downturn.

Asset Allocation: Striking the Right Balance

Asset allocation involves dividing your investments among different asset classes, such as stocks, bonds, real estate, and commodities. The ideal allocation depends on your risk tolerance, time horizon, and investment goals. A balanced portfolio diversifies risk and enhances the potential for steady returns.

Low-Risk Investment Strategies

For investors seeking low-risk options, consider the following strategies:

- High-yield savings accounts: Offer higher interest rates than traditional savings accounts, providing a stable and low-risk return.

- Certificates of deposit (CDs): Fixed-term savings accounts with a locked-in interest rate, offering moderate returns with minimal risk.

- Government bonds: Issued by governments, these bonds provide low-risk returns and stability.

- Real estate investment trusts (REITs): Invest in income-generating real estate properties, offering potential for modest returns and diversification.

High-Return Investment Strategies

For investors willing to assume higher risk, consider these strategies:

- Growth stocks: Companies with high growth potential and share appreciation potential, offering the potential for significant returns but also higher volatility.

- Dividend growth stocks: Companies that pay and consistently increase dividends, providing a steady income stream and potential for capital appreciation.

- Emerging market stocks: Stocks from developing countries that offer higher potential returns but also higher risks due to political and economic instability.

- Venture capital: Investing in early-stage companies with the potential for high returns but also a high risk of failure.

Alternative Investments

Beyond traditional investments, alternative investments can potentially enhance returns and diversify portfolios. These include:

- Private equity: Investing in private companies directly, offering the potential for high returns but also illiquidity and higher risks.

- Hedge funds: Actively managed investment funds that seek to hedge against market volatility, potentially offering higher returns but also higher fees and risks.

- Commodities: Investing in raw materials like gold, silver, and oil, providing the potential for inflation protection but also price volatility.

Caution and Due Diligence

When pursuing high rates of return, it's crucial toexercise caution and conduct thorough due diligence. Research investment options carefully, consult financial advisors if necessary, and understand the risks involved before committing your funds. Beware of scams and unrealistic return claims.

Earning high rates of return safely requires a comprehensive approach that considers risk tolerance, diversification, asset allocation, and prudent investment strategies. By navigating the investment landscape with knowledge and caution, you can maximize your financial potential while preserving the integrity of your investments.

Free Download your copy of "How to Earn High Rates of Returns Safely" today and unlock the secrets to financial success!

4.2 out of 5

| Language | : | English |

| File size | : | 2889 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Word Wise | : | Enabled |

| Print length | : | 288 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Steven Levenkron

Steven Levenkron Paul Brodie

Paul Brodie Rob Fitzpatrick

Rob Fitzpatrick Mark Dice

Mark Dice Rosemary Mahoney

Rosemary Mahoney Steve Mcnaughton

Steve Mcnaughton Peter Lewin

Peter Lewin Y R Davis

Y R Davis Maria Midkiff

Maria Midkiff William Hanson

William Hanson Martha Raile Alligood

Martha Raile Alligood Matthew Brenden Wood

Matthew Brenden Wood Mike Sonnenberg

Mike Sonnenberg Marianne Leone

Marianne Leone Merrie Destefano

Merrie Destefano Scott Hoover

Scott Hoover Maurice Kogon

Maurice Kogon Richard Duncan

Richard Duncan Matt Goldwasser

Matt Goldwasser Mark Weakland

Mark Weakland

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Casey BellBuild a Beautiful and Functional Retaining Wall with DIY Retaining Wall Block...

Casey BellBuild a Beautiful and Functional Retaining Wall with DIY Retaining Wall Block...

David BaldacciMargaret Fuller: New American Life - Illuminating the Path of a Literary and...

David BaldacciMargaret Fuller: New American Life - Illuminating the Path of a Literary and... Doug PriceFollow ·16k

Doug PriceFollow ·16k Marc FosterFollow ·19.8k

Marc FosterFollow ·19.8k Cameron ReedFollow ·9.5k

Cameron ReedFollow ·9.5k Marcel ProustFollow ·7.4k

Marcel ProustFollow ·7.4k Rick NelsonFollow ·5.7k

Rick NelsonFollow ·5.7k Tom ClancyFollow ·6.2k

Tom ClancyFollow ·6.2k Ross NelsonFollow ·18.5k

Ross NelsonFollow ·18.5k Ernesto SabatoFollow ·6.6k

Ernesto SabatoFollow ·6.6k

Larry Reed

Larry ReedGwendy's Final Task: A Thrilling Conclusion to a Timeless...

Prepare to be...

Victor Turner

Victor TurnerHow FDR Defied Polio to Win the Presidency

Franklin D. Roosevelt is...

Edwin Cox

Edwin CoxWinner RGS BBC Journey of a Lifetime Award: An Inspiring...

In the heart of the world's...

Griffin Mitchell

Griffin MitchellEverything You Need to Know, You Learned From Mister...

Mister Rogers' Neighborhood was a beloved...

Beau Carter

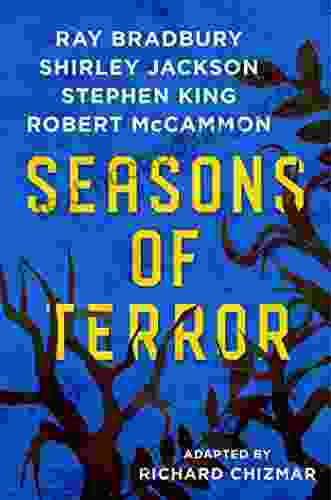

Beau CarterSeasons of Terror: A Spine-Tingling Odyssey into the...

In the realm of horror...

4.2 out of 5

| Language | : | English |

| File size | : | 2889 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Word Wise | : | Enabled |

| Print length | : | 288 pages |