Lessons of Lehman Brothers: How Systemic Risk Can Still Bring Down the World

The collapse of Lehman Brothers in 2008 was one of the most significant financial events in history. It triggered a global financial crisis that had devastating consequences for the world economy. In this book, the author argues that the lessons of Lehman Brothers have not been fully learned, and that systemic risk still poses a threat to the global financial system.

4.5 out of 5

| Language | : | English |

| File size | : | 809 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 256 pages |

| Paperback | : | 368 pages |

| Item Weight | : | 14.8 ounces |

| Dimensions | : | 5.3 x 0.8 x 8.45 inches |

| Screen Reader | : | Supported |

The Collapse of Lehman Brothers

Lehman Brothers was a global investment bank that was founded in 1850. The firm had a long history of success, but it began to struggle in the early 2000s as the subprime mortgage market began to collapse. Lehman Brothers made a number of risky bets on the housing market, and when the market crashed, the firm was left with billions of dollars in losses.

In September 2008, Lehman Brothers filed for bankruptcy. The collapse of the firm sent shockwaves through the global financial system. It led to a loss of confidence in the financial markets, and it caused a sharp decline in the stock market.

The Global Financial Crisis

The collapse of Lehman Brothers triggered a global financial crisis. The crisis had a devastating impact on the world economy. It led to a loss of jobs, a decline in economic growth, and a rise in poverty.

The financial crisis also led to a loss of confidence in the financial system. Many people lost faith in the banks and other financial institutions. This loss of confidence made it difficult for businesses to borrow money and invest, which further slowed the economy.

The Lessons of Lehman Brothers

The collapse of Lehman Brothers and the subsequent global financial crisis taught us a number of important lessons about systemic risk.

- Systemic risk is a real threat to the global financial system. Lehman Brothers was not the only financial institution to fail during the financial crisis. Many other banks and investment firms also collapsed, which showed that systemic risk is a real threat to the global financial system.

- The financial system is interconnected. The failure of one financial institution can have a ripple effect that can impact the entire financial system. This is because financial institutions are interconnected through a complex web of relationships.

- Regulators need to be vigilant in monitoring systemic risk. The collapse of Lehman Brothers showed that regulators need to be vigilant in monitoring systemic risk. Regulators need to be able to identify and address risks before they can cause a financial crisis.

Systemic Risk Today

The lessons of Lehman Brothers are still relevant today. Systemic risk is still a threat to the global financial system. The financial system is still interconnected, and regulators need to be vigilant in monitoring systemic risk.

There are a number of things that can be done to reduce systemic risk. One important step is to increase the capital requirements for banks and other financial institutions. This will make financial institutions more resilient to losses and less likely to fail.

Another important step is to reduce the interconnectedness of the financial system. This can be done by creating firewalls between different parts of the financial system. For example, banks can be prohibited from owning investment banks.

Finally, regulators need to be more vigilant in monitoring systemic risk. Regulators need to be able to identify and address risks before they can cause a financial crisis.

The collapse of Lehman Brothers was a wake-up call for the world. It showed us that systemic risk is a real threat to the global financial system. We need to learn the lessons of Lehman Brothers and take steps to reduce systemic risk.

If we do not learn from the past, we are doomed to repeat it.

4.5 out of 5

| Language | : | English |

| File size | : | 809 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 256 pages |

| Paperback | : | 368 pages |

| Item Weight | : | 14.8 ounces |

| Dimensions | : | 5.3 x 0.8 x 8.45 inches |

| Screen Reader | : | Supported |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Y R Davis

Y R Davis Martin W Bowman

Martin W Bowman Todd Speciale

Todd Speciale Meg Cabot

Meg Cabot Tim R Wolf

Tim R Wolf Matt K Parker

Matt K Parker Robert Samuels

Robert Samuels Querida Lu Ahn Funck

Querida Lu Ahn Funck Mari Mancusi

Mari Mancusi Mark Condon

Mark Condon Martin Liebscher

Martin Liebscher Michael P Spradlin

Michael P Spradlin Paul Howard

Paul Howard Olu O

Olu O Mark Zondo

Mark Zondo Mary Quinlan Mcgrath

Mary Quinlan Mcgrath Mary E Davis

Mary E Davis Matthew Kerns

Matthew Kerns Matthew Stavros

Matthew Stavros Mark Obmascik

Mark Obmascik

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

José SaramagoFollow ·4k

José SaramagoFollow ·4k Cristian CoxFollow ·19.9k

Cristian CoxFollow ·19.9k Angelo WardFollow ·9.6k

Angelo WardFollow ·9.6k Samuel Taylor ColeridgeFollow ·10.4k

Samuel Taylor ColeridgeFollow ·10.4k Jackson BlairFollow ·6.7k

Jackson BlairFollow ·6.7k Brett SimmonsFollow ·11.8k

Brett SimmonsFollow ·11.8k Lee SimmonsFollow ·10.7k

Lee SimmonsFollow ·10.7k Kelly BlairFollow ·11.3k

Kelly BlairFollow ·11.3k

Larry Reed

Larry ReedGwendy's Final Task: A Thrilling Conclusion to a Timeless...

Prepare to be...

Victor Turner

Victor TurnerHow FDR Defied Polio to Win the Presidency

Franklin D. Roosevelt is...

Edwin Cox

Edwin CoxWinner RGS BBC Journey of a Lifetime Award: An Inspiring...

In the heart of the world's...

Griffin Mitchell

Griffin MitchellEverything You Need to Know, You Learned From Mister...

Mister Rogers' Neighborhood was a beloved...

Beau Carter

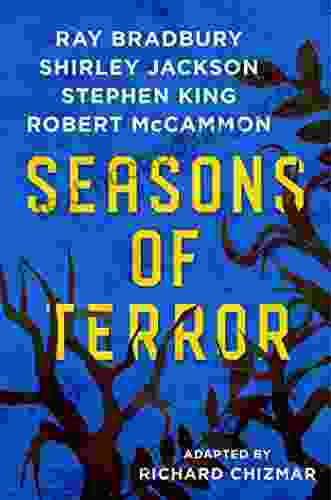

Beau CarterSeasons of Terror: A Spine-Tingling Odyssey into the...

In the realm of horror...

4.5 out of 5

| Language | : | English |

| File size | : | 809 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 256 pages |

| Paperback | : | 368 pages |

| Item Weight | : | 14.8 ounces |

| Dimensions | : | 5.3 x 0.8 x 8.45 inches |

| Screen Reader | : | Supported |